rasar Bharati has been showering undue favours on Intelsat

Corporation, an American company that made satellite arrangements to

provide a European beam, an Indian beam and a US link to India's

public service broadcaster. The favours came primarily in two forms:

paying Intelsat Rs 18 cr more than the contracted amount; and

extending its services in spite of objections from the Finance

Department and even though ISRO was providing the same services for

half the rate.

Prasar Bharati paid approximately Rs 300 cr to Intelsat, earlier

known as PanAmSat, from 1995 onward for a period of 15 years. Prasar

kept depositing the "withholding tax" with the tax authorities on

behalf of Intelsat ever since that tax became payable. The

utilization of the services provided by Intelsat was negligible. The

scandal first came to light in 2009 when the Finance Department of

Prasar Bharati mentioned about it in a note dated 13/03/09. A copy

of the note is with The Sunday Guardian.

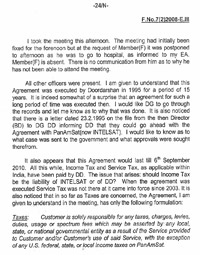

A copy of B.S. Lalliís internal note to Director General Aruna

Sharma in September 2009.

"However, such tax should have been deducted from the contracted

payment to be made to the party. Instead the payments have been made

in addition to the contracted amount resulting in excess payments

running into crores," the note says.

The then Prasar CEO B.S. Lalli was informed that an excess payment

of Rs 18 cr had been made to Intelsat. Lalli in his internal note to

Director General Aruna Sharma in September 2009 expressed his shock

and asked for a report. "It is indeed somewhat of a surprise that an

Agreement for such a long period of time was executed then. There is

logic in the arguments that as to why should Doordarshan pay the

Income tax while the Income is going to Intelsat," Lalli's letter

added.

But when the contract between Doordarshan and Intelsat was about to

expire in September 2010, both Sharma and Lalli granted the American

company an extension of six months, up to March 2011, on the basis

of a single party enquiry. This was done when the row over tax

liability had not been settled and was being pursued with the Income

Tax Department. A note sent by Member (Finance) dated 26 August

2010, objected to the proposed extension by saying, "Financial rules

do not permit approval of any agreement with Intelsat or any other

party based on a single party enquiry without going through a proper

procedure of open tendering."

Minutes of the Prasar board meeting and several documents accessed

by this newspaper show that there was deliberate delay on the part

of the authorities to sort out the tax issue. Earlier in 2009 Lalli

referred the matter to Solicitor General (SG) Gopal Subramanium for

advice. The SG through his letter dated 02/09/09 said that while

payments should be released to Intelsat, possibilities should be

explored to recover dues through the Income Tax Department.

The matter was taken up by the Prasar board on 3 January 2011 where

it was pointed out that alternate satellite arrangements to meet

Doordarshan's urgent requirements had already been made through ISRO

at almost half the cost.

It was also pointed out that it was essential to settle the tax

liability issue before releasing any payment to Intelsat. Prasar has

been issuing TDS certificates and any excess credits obtained by

Intelsat from the tax authority were to be adjusted in its favour.

The board, however, ignored the matter and CEO Rajiv Takru ordered

the release of Rs 14.91 cr. This was released on 1 March 2011 to the

Income Tax Department to the credit of Intelsat.

The Sunday Guardian has also accessed the income tax assessment

order of the American company, where it has under declared its

income for the year 2006-2007. The Income-Tax Department has levied

tax at the rate of 10% on revenues, whereas Prasar has been

depositing tax at 11.1% rate all these years. So 1.1% excess tax was

deposited by Prasar all these years.

The Finance Department of Prasar suggested that it needed to adjust

the excess withholding tax deposited for Intelsat before releasing

any fresh payment. The scandal was also reported to the Ministry of

Information & Broadcasting but no action has been taken in this case

so far.

Sources told The Sunday Guardian that certain officials wanted

Intelsat to derive financial benefits from the deal. "Services were

reviewed and to reduce cost it was decided that just one satellite

would be hired. Since the utilization of

Intelsat services was low, and there were hardly any viewers in

western country for Doordarshan programmes, a proposal to revive

programming was discussed. And in future when we get the viewers in

Europe and America we may hire point to point service through optic

links," sources added.